BitIRA | The Essential Guide to Digital IRAs

What Are Digital Currencies, And How Do They Work?

A variety of digital currencies exist today. You’re probably familiar with the most popular ones like bitcoin , ethereum, and litecoin, but there are also hundreds of other “altcoins.”

However, the underlying mechanics behind all digital currencies are essentially the same.

First of all, each digital currency has its own network, built using a technology called blockchain.

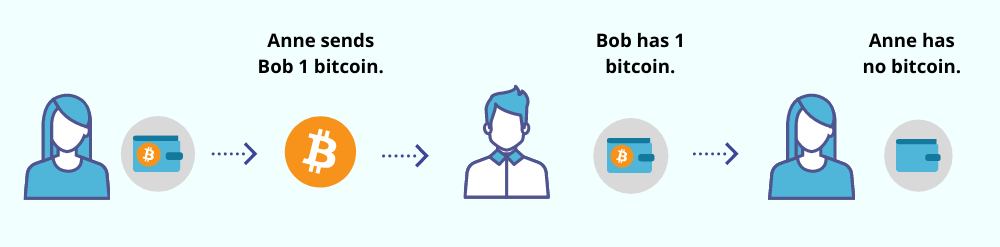

This network is a public ledger of confirmed transactions (or “blocks”) between individual users who store their currency in encrypted software “wallets.” Like any other ledger, transactions are recorded and validated: Anne wants to send Bob 1 bitcoin.

Does Anne’s wallet have 1 ₿? Yes. —> Anne’s wallet -1 ₿ —> Bob’s wallet +1

But the network does more than record transactions and maintain the books. It also facilitates the creation of new units of the currency.

Every time a transaction is submitted to the network, a “miner” — another member of the network or a group of members working as a mining “pool” — must use their computer resources to solve a computational problem (a complex mathematical puzzle) before the transaction is confirmed.

After miners confirm a transaction, they’re compensated with new pieces of the network’s currency in exchange for their use of resources, and a new “block” is added to the network. Rewarding the people who maintain the integrity of the network is one way to guarantee that transactions continue to run smoothly.

The network automatically increases the difficulty of computational puzzles required to “mine” new units of currency, based on previous activity. That’s why special, powerful computers are required to mine today’s most popular digital currencies like bitcoin.

By enforcing accountability, regulating the creation of new currency, and providing security, this “proof-of-work” system is what allows digital currencies to be used as money.

However, this technology doesn’t just make digital currencies a viable form of money. It also makes them a superior alternative to conventional monetary vehicles, and an especially attractive retirement investment asset.

Why?

Read on to learn why economists, tech titans, Wall Street firms, and Main Street banks are all excited about digital currencies…

“[Bitcoin] is a remarkable cryptographic achievement… The ability to create something which is not duplicable in the digital world has enormous value.”

– Eric Schmidt, Executive Chairman of Google

Continue Reading

Continue Reading

DISCLAIMER: The decision to purchase or sell virtual currencies (also known as “digital currencies” or “cryptocurrencies”), and which cryptocurrencies to purchase or sell, is ultimately your decision alone. Purchase and/or sale decisions are highly individual and must be a function of each customer’s individual financial situation, goals, and risk tolerance. BitIRA is not a financial planner, investment advisor or retirement specialist. BitIRA is not responsible for your decision to purchase or sell digital currencies, or the timing or results of any such act (or failure to act). Any and all assistance BitIRA may offer or provide does not create a fiduciary relationship between you and BitIRA. Any and all purchases and sales are made subject to your own research, prudence, and judgment. BitIRA does not provide tax, investment, financial planning, retirement-specific, or legal advisory services and no one associated with BitIRA is authorized to render any such advice or service. BitIRA is not responsible for any consequences of you purchasing cryptocurrencies for IRAs, trusts or other persons or entities, or for any changes in the laws relating to such purchases or sales. Any written or oral statements by BitIRA, its principals, agents, or representatives, relating to future events constitute opinions only, and are not representations of fact.